Cloud has established itself as the standard in business IT. Organizations are not just viewing the cloud as a platform but as an enabler to achieve new business objectives. Cloud has the ability to upscale or downscale resources in real-time as per the requirement of the dynamic business needs. This enables businesses to move quicker, innovate more, and sharpen their competitive edge.

As businesses embrace the cloud's numerous advantages, keeping track of cloud spend is a constant struggle. According to Gartner Inc., enterprise IT spending on public cloud computing will overtake spending on traditional IT by 2025.

The cloud infrastructure, unlike on-premise technology stacks, is a dynamic environment. The downside of this nature is that things get complicated very quickly. Most public cloud providers use a payment model based on resource usage. This results in a bill with hundreds of line items which is difficult to understand & optimize due to the varying levels of resource usage at different times. However, if the consumption is regularly monitored, this model may result in considerable savings. Also, without proper Cloud Financial Management products in place, it is quite easy for expenditures to spiral out of control due to the complex nature of the cloud infrastructure and pay-as-per-use pricing model.

Some of the cost contributors in the cloud include:

Cloud charges become opaque due to the pay-as-per use pricing model and tracking your spend on a regular basis becomes more difficult. Businesses have been caught off guard when their cloud bill arrives. A CSP's bill is often a complicated maze, densely packed with information.

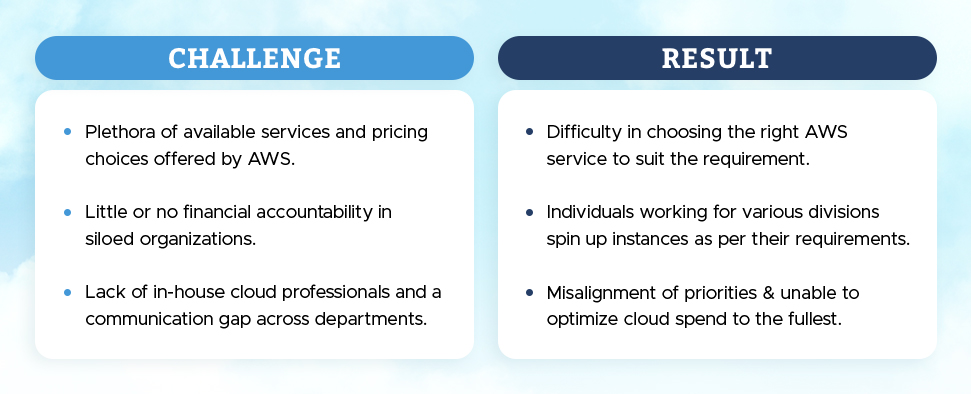

Other challenges that add to the increase in cloud spends:

These challenges necessitate the implementation of a company-wide cloud cost management plan.

What is Cloud Financial Management and how does it help?

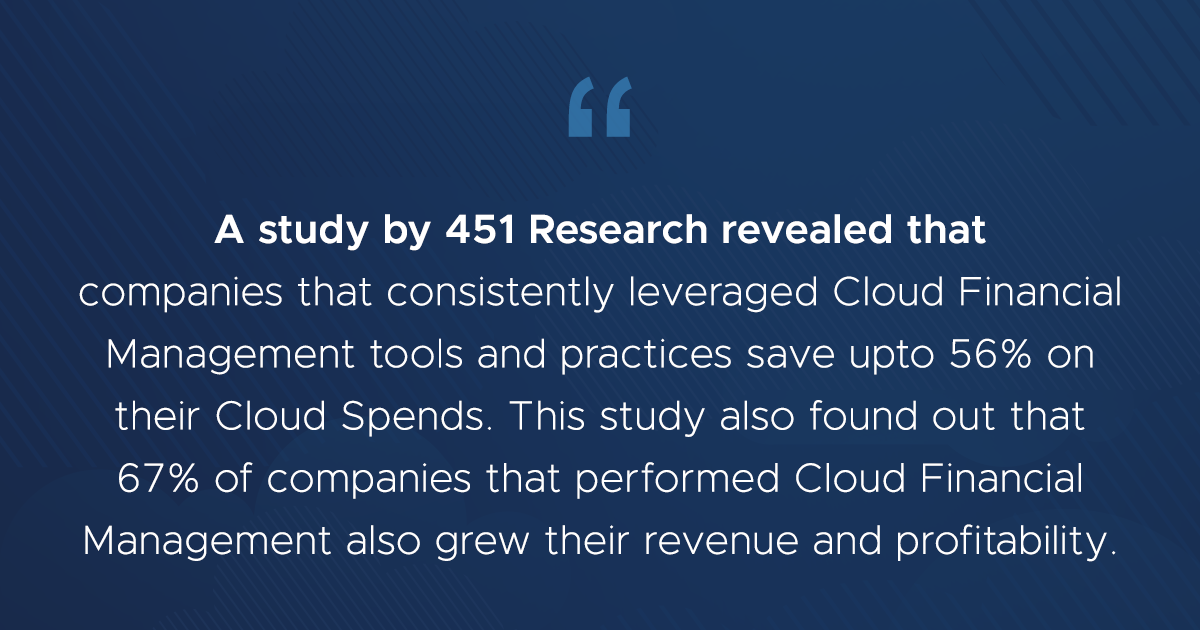

Cloud Financial Management enables businesses to make the most of the cloud infrastructure and keep control on spends while also ensuring that the benefits of the cloud such as scalability, security, and flexibility are available across the organization. It is feasible and crucial to instill a cost-conscious culture across the organization when it comes to cloud infrastructure planning and management.

Cloud Financial Management tools are critical not just for cost control, but also for ensuring that cloud investments provide the desired results. It also has the added benefit of increasing accountability across all teams and departments, increasing the likelihood of attaining projected business objectives.

The need of the hour is an organizational planning discipline, a FinOps practice, that enables a business to understand and manage its cloud technology-related costs and needs effectively. This involves finding cost-effective ways to optimize cloud usage via FinOps and workload management. Organizations should be looking at the new FinOps paradigm to rethink how they approach cloud spending to save big on their cloud expenses in the coming years.

Optimizing your cloud costs requires a smart cloud strategy right from the resource planning phase. With our AWS Certified experts by your side, rest assured that you will get to save big on your cloud costs without compromising on your performance benchmarks. Sounds interesting? Talk to our experts today.