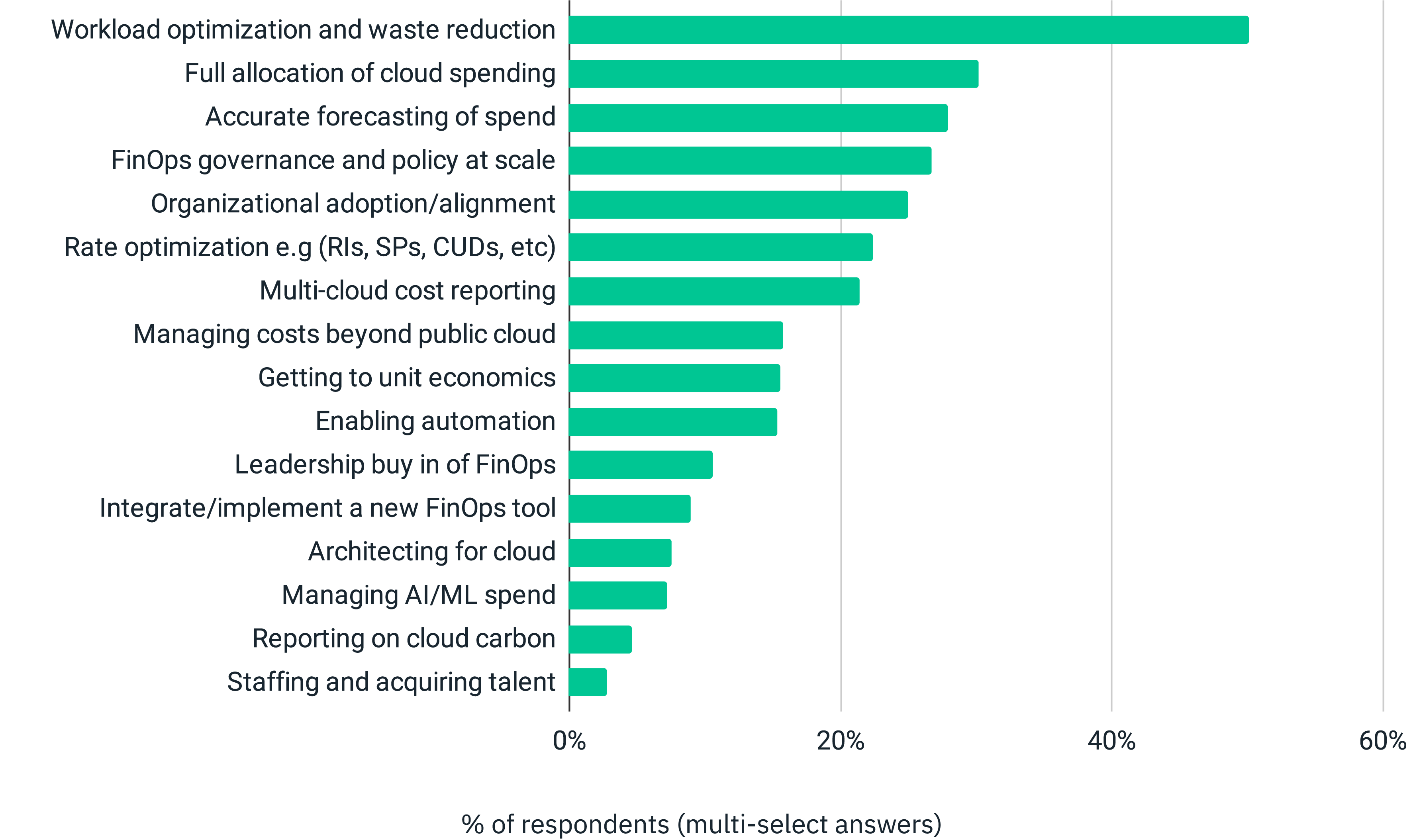

Remember when cloud computing was supposed to solve all our cost problems? Yet here we are, with most of us staring at our cloud bills wondering where exactly all that spending is going. Turns out, we're not alone. The recent State of FinOps 2025 Report by FinOps Foundation, shows that workload optimization and waste reduction are keeping 50% of FinOps practitioners up at night.

Shift towards Governance and Automation

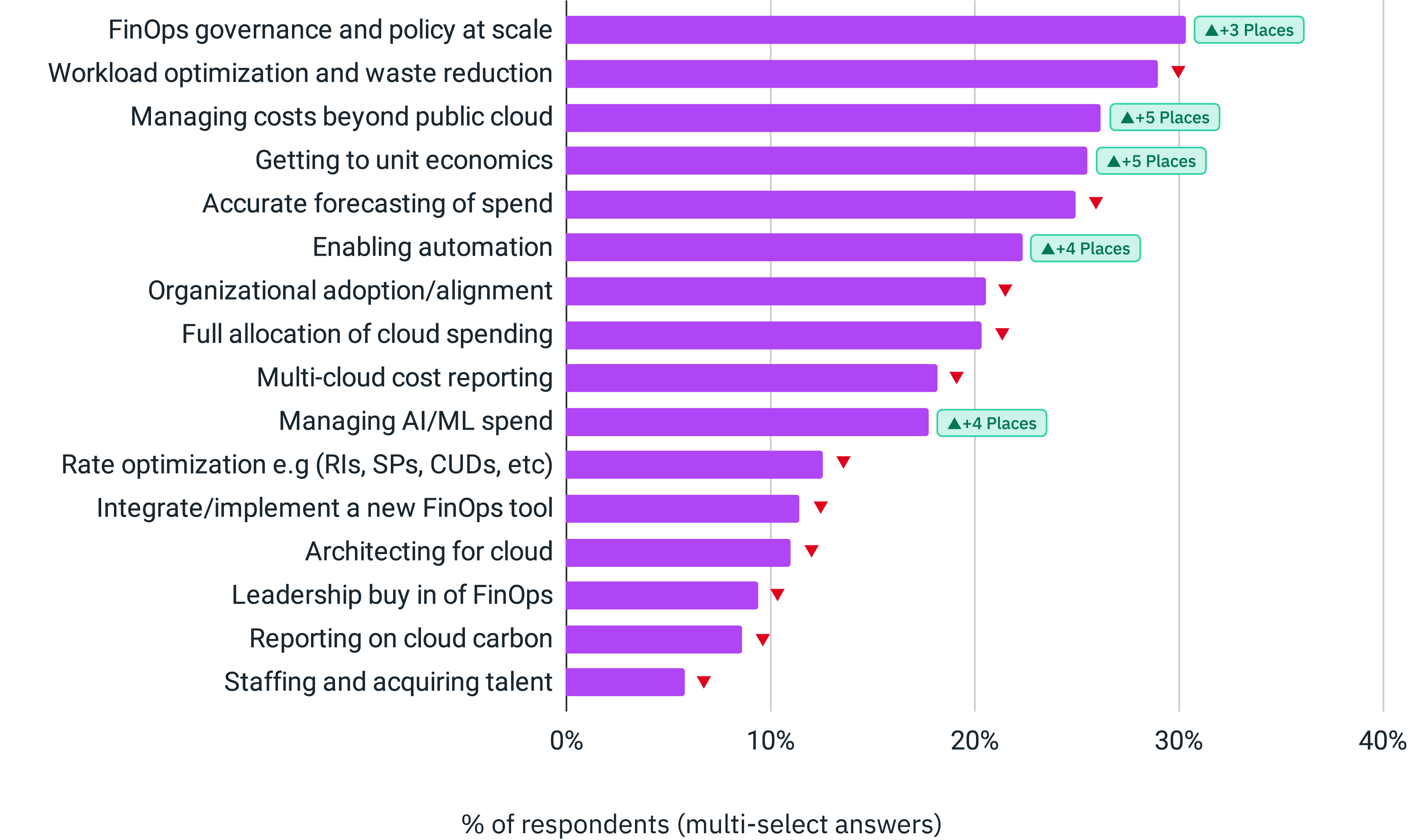

But here's what's fascinating: while we're all trying to get a handle on cloud costs, the landscape is shifting beneath our feet. The data in the State of FinOps 2025 Report tells an interesting story. While workload optimization tops today's priority list, there's a clear pivot happening towards governance and automation. It's like watching the FinOps community collectively realize that throwing more spreadsheets at the problem isn't the answer.

This hits close to home. In my conversations with cloud architects and FinOps leaders, I keep hearing the same thing: "We know we're wasting money, but finding where and fixing it manually is like trying to find a needle in a digital haystack."

CloudKeeper Tuner, an automated usage optimization platform is already helping organizations tackle these exact challenges. Think of it as having a tireless Cloud FinOps engineer working 24*7, spotting unused resources, optimizing workloads, and even automatically switching between Spot and On-Demand instances to save costs while keeping the performance optimal.

The best part? It's not just about cost-cutting. It's about bringing intelligence and automation to your cloud operations. When I see it automatically shutting down idle resources during off-hours or providing tailored modernization recommendations, I'm reminded that good FinOps isn't about penny-pinching - it's about smart resource usage.

Within 24 hours of implementation (which takes just minutes), teams start seeing real savings - we're talking an average of 10% off AWS bills. But beyond the numbers, it's about giving teams back their time to focus on innovation rather than cloud cost management.

Let’s uncover some more interesting insights from the State of FinOps 2025 Report.

The "Cloud+" Era: FinOps beyond the cloud

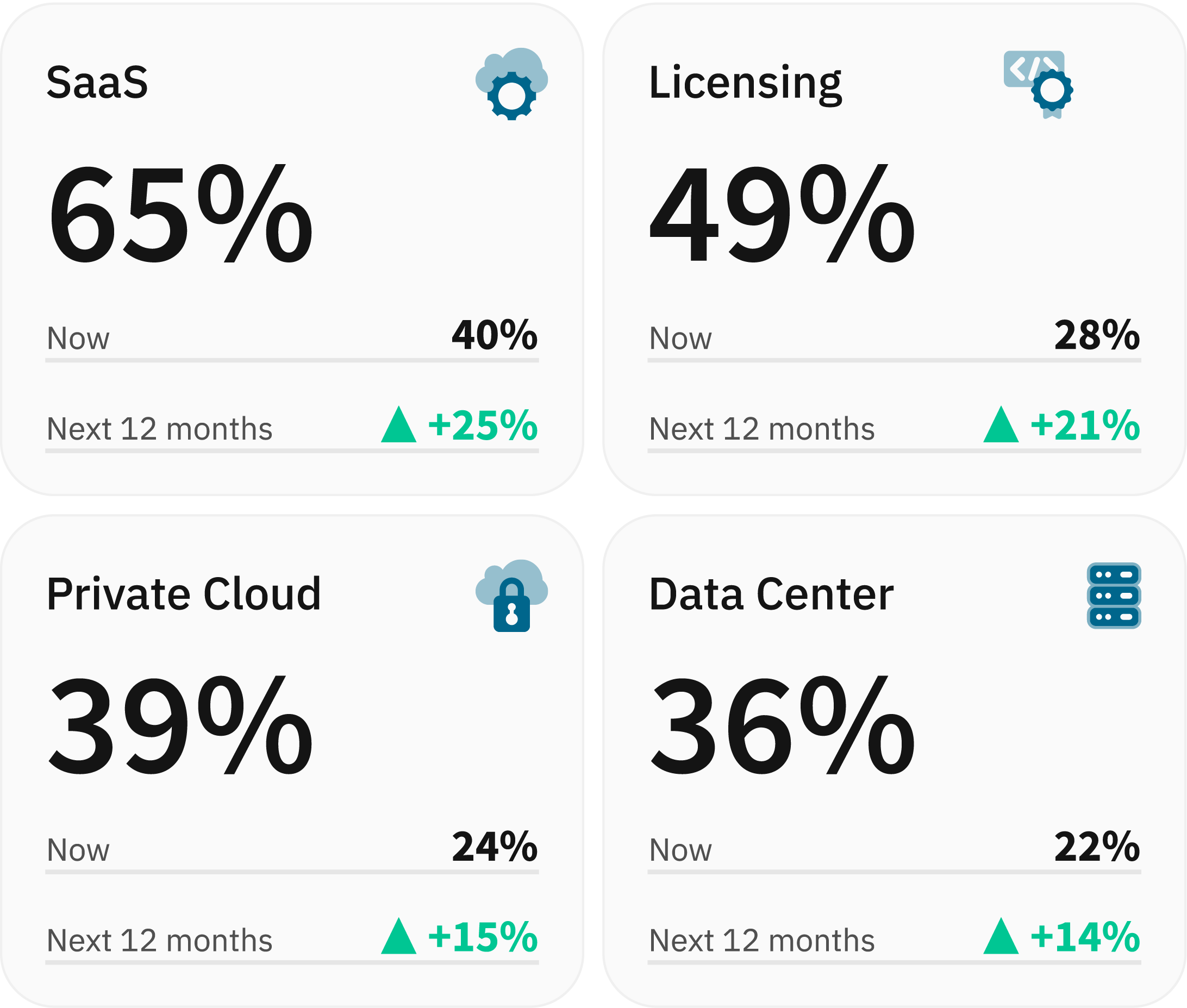

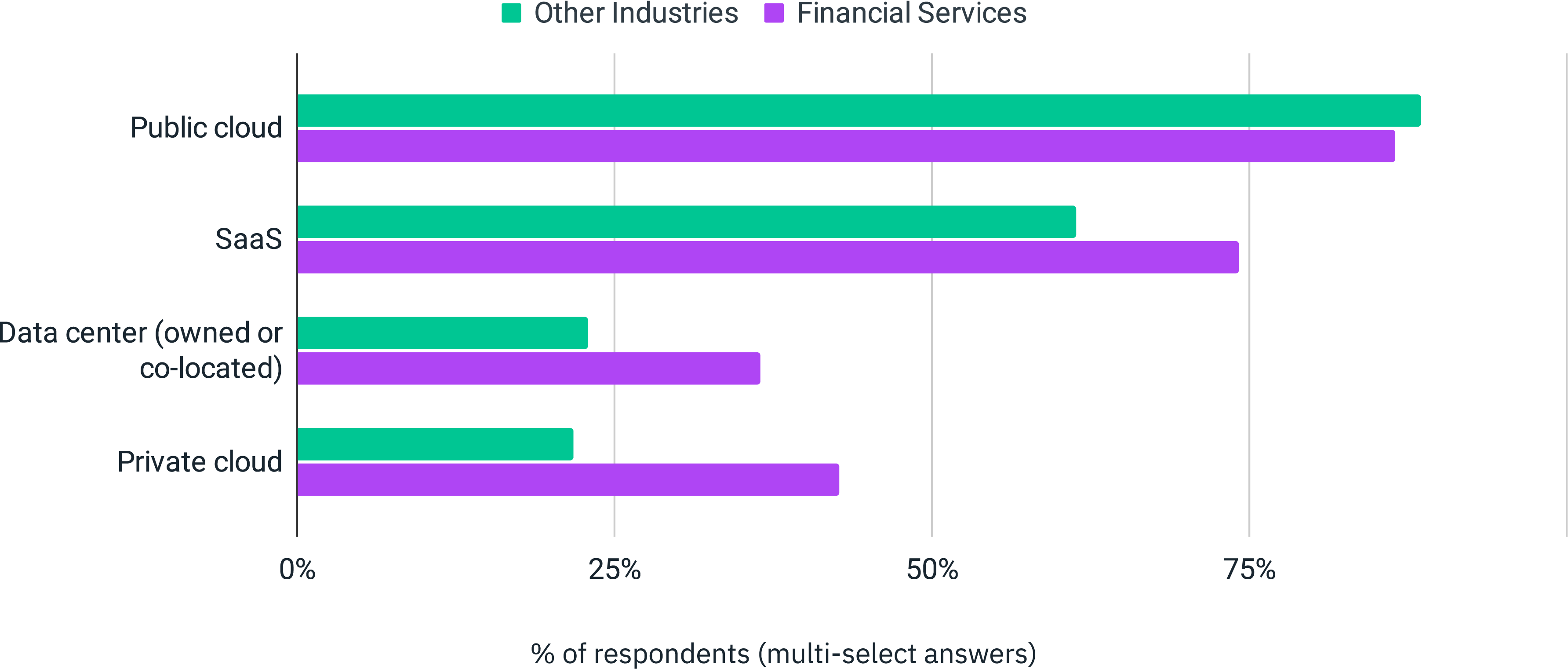

We've been so focused on cloud costs for so long, that it's easy to forget that technology spending extends way beyond those virtual servers. The State of FinOps 2025 report highlights a really interesting trend: FinOps is growing up. It's moving beyond just the public cloud and embracing a "Cloud+" approach.

What does "Cloud+" actually mean?

Essentially, it's about applying the same FinOps principles and practices we've developed for managing public cloud costs to all technology spending. This includes:

- SaaS (Software as a Service): Think about all those subscriptions: CRM, project management, communication tools. They add up fast, and many companies are now using FinOps to get a handle on them.

- Licensing: Software licenses, especially for enterprise-grade applications, can be a huge expense. FinOps is helping businesses understand and optimize these costs.

- Private Cloud and Data Centers: Even if you're not fully in the public cloud, you still have infrastructure costs to manage. FinOps is being used to bring transparency and efficiency to these areas.

Initially, practitioners are applying foundational FinOps capabilities, such as cost understanding and value quantification, to these new areas. As they gain better visibility and maturity, optimization efforts will follow.

Public cloud dominates AI investment

According to the State of FinOps 2025 Report, organizations are prioritizing AI investments in the public cloud, with 69% directing funds toward SaaS solutions and 30% investing in data centers or private cloud.

Right now, the top priority in AI cost management is understanding usage and quantifying business value, with a strong emphasis on allocation, data ingestion, reporting, anomaly detection, and forecasting. Optimization isn’t a key focus yet, but as businesses gain better visibility into AI costs, aligning spending with business goals will become increasingly important.

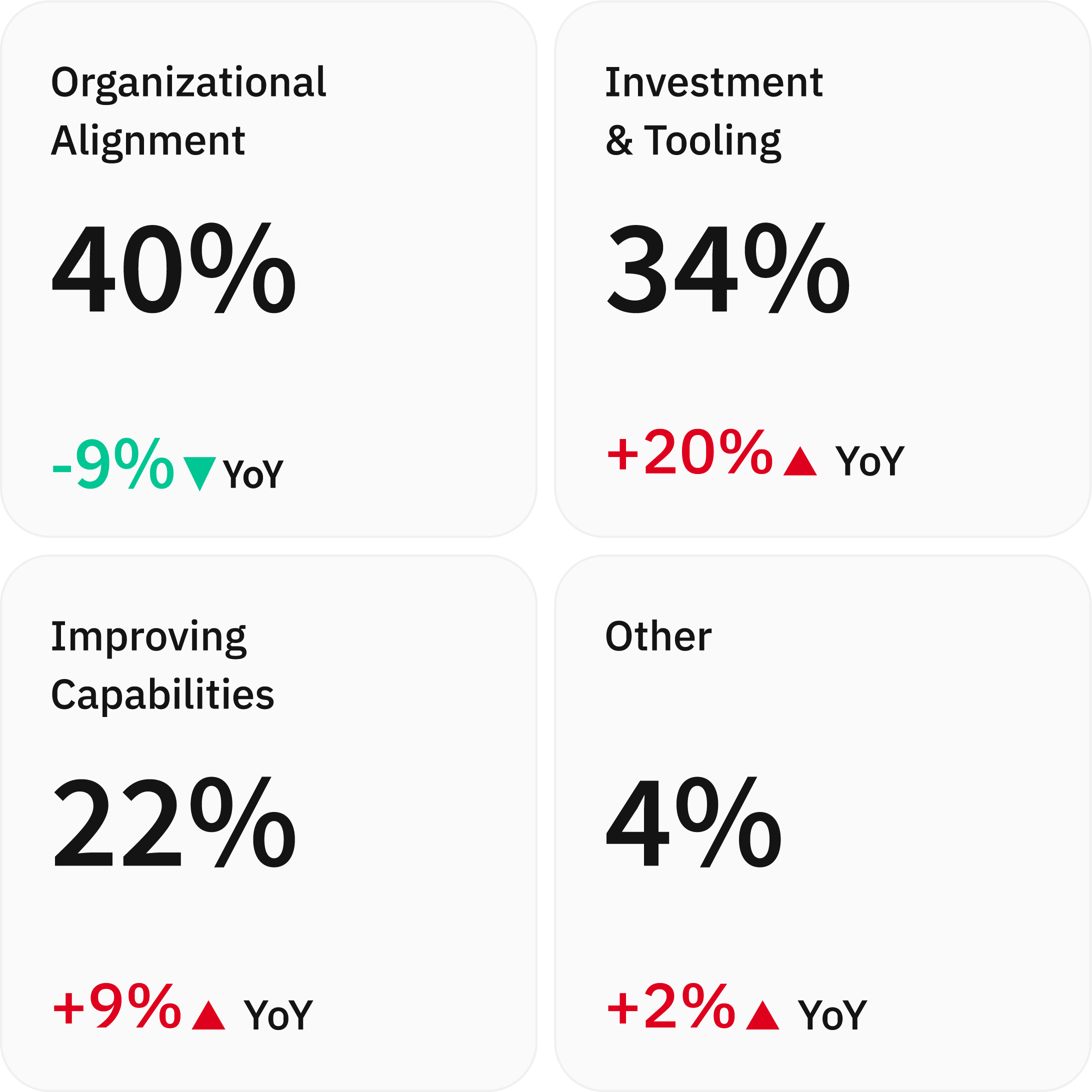

Organizational alignment remains key, but investment in tools gains momentum

Organizational alignment (like leadership buy-in) is still the top factor in achieving FinOps priorities, but its importance has dropped by 9% compared to last year, a positive sign for growth in FinOps adoption growth. Meanwhile, investment in tooling and resources has surged by 20%, with key needs including upskilling, automation, and productivity tools.

This completely makes sense as leadership support solidifies, the focus must shift toward resourcing and efficiency, especially as FinOps workloads continue to grow.

If your company is still figuring out how to get started with FinOps or scale it with the right tools and resources, we’re just a call away!

FinOps Practitioners are taking on More – But at what cost?

The State of FinOps 2025 Report shows, FinOps practitioners are taking on more than ever, increasing focus on nearly 12 capabilities. With workloads growing but resources staying the same, teams are at risk of spreading themselves too thin. With limited time and resources, trying to improve everything at once can dilute focus and reduce overall impact.

To be effective, FinOps teams need to prioritize. Instead of stretching themselves across too many areas, they should strategically allocate their efforts to the most valuable opportunities.

Cloud Sustainability: Still more talk than action

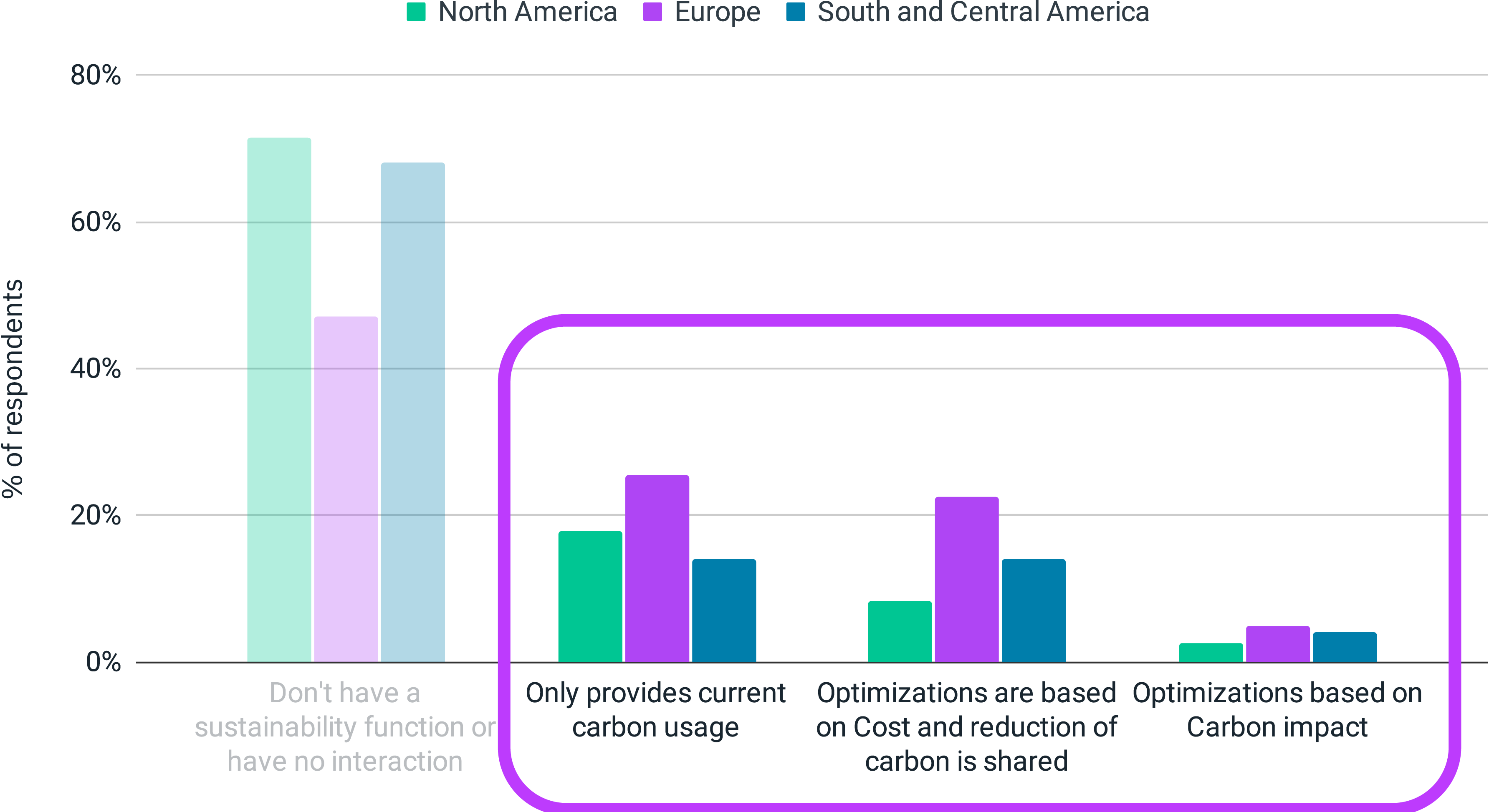

Cloud sustainability reporting hasn’t changed much over the past year, with only a 1% increase globally. While Europe leads the way—with 53% of organizations tracking cloud carbon emissions (up 18% YoY)—North America remains stagnant at 29%.

But here’s the real takeaway: cost still rules the decision-making. Only 3% of FinOps teams optimize cloud costs based on carbon impact, while 15% focus purely on cost savings. Despite the rise in ESG initiatives, sustainability efforts are still more about visibility than action.

FOCUS adoption is growing, but challenges persist

More than half of FinOps practitioners plan to adopt FOCUS (FinOps Open Cost and Usage Specification) in the next 12 months, according to the State of FinOps 2025 Report. However, adoption isn’t without hurdles.

- 57% have plans to use FOCUS.

- 24% are still figuring out their approach.

- 18% don’t plan to adopt it at all.

The main barriers to adoption include time constraints, skill gaps, and dependency on billing providers. Some organizations are also holding off until more SaaS vendors align with the standard.

With the release of FOCUS 1.2, which incorporates SaaS data, adoption is expected to grow. As more providers standardize billing data, cost transparency and FinOps processes will become more efficient.

The Final Thoughts

Looking to 2025, the State of FinOps 2025 Report makes one thing clear, FinOps is evolving fast. It's not just limited to public cloud costs anymore. To stay ahead, organizations must:

- Establish Robust Governance – Build strong frameworks to manage costs effectively.

- Invest in Skills & Automation – Empower teams with training and advanced tools.

- Tackle AI Cost Challenges – Prepare for the complexities of AI-driven spending.

- Expand Beyond Cloud – Develop a holistic strategy for managing all technology costs.

At CloudKeeper, we're excited to be part of the FinOps evolution by empowering organizations with the right tools and capabilities to navigate these FinOps challenges with confidence.

We'd love to hear your perspectives on these trends and discuss how we can support your journey!

About the State of FinOps 2025 Report by FinOps Foundation

The State of FinOps 2025 Report marks the fifth annual survey conducted within the FinOps Foundation community. This year's respondents include large enterprise organizations, with 31% spending over $50 million annually on public cloud, 20% exceeding $100 million per year, and more than 20 companies surpassing $1 billion in cloud expenditures. Additionally, 41% of respondents come from organizations with over 20,000 employees, while 15% represent companies with more than 100,000 employees.